Explain Three Key Differences Between Index Funds and Mutual Funds.

Ad Learn why mutual funds may not be tailored to meet your retirement needs. Mutual funds which include index funds pool investors money and allow them to participate in the stock market without taking on the risks costs and research of investing in individual stocks or other kinds of.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-03-16f9ea45d66c4e87ab370f8eb05f00d0.jpg)

The Hidden Differences Between Index Funds

The key differences between index ETFs and index funds are.

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

. The difference between open-ended and closed-ended funds can be drawn clearly on the following grounds. For example if an index fund follows the BSE Index as the replicating index and if it has a 20 weightage in lets say Stock A then the index fund will also invest 20. Clearly something else is going on.

Index funds are ideal for investors who want to invest in equity mutual funds but at the same time dont want to depend on the fund manager. The two terms refer to distinct categories. Mutual funds are actively managed while index funds are passively managed.

ETFs trade throughout the day while index funds trade once at market close. While mutual funds are managed actively ETFs are managed passively. Index-tracking ETFs have lower expenses than index-tracking mutual funds and the actively-managed ETFs out there are cheaper than actively-managed mutual funds.

Open-ended funds refer to the mutual fund in which the investor is allowed to buy shares anytime even after the closure of the NFO ie. Mutual funds are handled by professionals whereas ETFs replicate an underlying securities index. An index mutual fund follows the same strategy as the index it is based on.

The expense issue is one reason why actively managed funds underperform their index. Actively-managed funds can help with investment decision-making. Index funds are a type of mutual fund or exchange-traded fund ETF that mirror the performance of a specific stock market index.

A hedge fund is an investment that is designed to give you a decent return. Both hedge funds and mutual funds work by pooling capital from a large number of investors and investing it with the aid of a fund manager for a predetermined fee. Download the app today.

And thats where the similarities end. Mutual funds are bought in the private market while hedge funds in public markets. As for Index funds the objective is to reflect how a particular index is performing.

Mutual funds deal with stocks while hedge funds deal with bonds. Conversely in mutual funds the main aim is to come on top of the market. Mutual funds collect money from investors while hedge funds from companies.

Index Funds vs. The main difference between Hedge fund and Mutual fund is that mutual funds will provide you with a minimum return rate that is known as the risk-free rate. The key difference between the two is that hedge funds chase the big fish investments that are high risk high reward.

One of the major differences between an index fund and a mutual fund especially an actively-managed one is their management style - namely whether they are active or passive. In contrast index funds are closed-ended. Ad The money app for families.

The investment style of the fund is another mutual fund differentiator. Actively managed funds start at a disadvantage when compared to index funds. On the other hand the hedge fund will try to maximize your return on your investment.

Aubree wanted to see if there is a connection between the time a given exam takes place and the average score of this exam. Understanding the differences between index funds vs. Compare Index Funds vs Mutual Funds Compare - Index Funds Vs Mutual Funds Both index funds and mutual funds are used to diversify the portfolio.

The cost of investing in index funds is lesser because it relies mainly on computers while the cost of investing in mutual funds is more because it relies on a team of investment analysts and traders. The average ongoing management expense of an actively managed fund costs 1 more than its passively managed cousin. Thats the Greenlight effect.

Identify the type of function represented by fx 4 2x O A. ETFs are often cheaper than index funds if bought commission. The Difference Between an Index Fund and a Mutual Fund.

Index Funds vs. Growth funds as the name suggests seek stocks that fund managers believe will have better than average returns. Mutual fund refers to a funds structure whereas index fund refers to a funds investment strategy.

Key Differences Between Open-ended and Closed-ended Funds. Fundamentally the funds that follow the active approach carefully choose investments that will guarantee a good return in comparison with the market. Explain three key differences between index funds and mutual funds.

The Differences That Matter The three main differences are management style investment objective and cost and index funds are the clear winner. A stock market index measures a particular sector of the market. Get this must-read guide if you are considering investing in mutual funds.

The main difference between an ETF and an index fund is ETFs can be traded bought and sold during the day and index funds can only be traded at the set price point at the end of the trading day. Mutual funds are sold in the primary market while hedge funds in the secondary market.

Best Mutual Funds In India To Invest In 2022 Top Performed

How To Invest In Index Funds A Beginner S Guide Nextadvisor With Time

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

Index Funds Investing 101 A Complete Beginner S Guide

Trade Etfs Exchange Traded Funds Your Guide To Etfs Trading Capital Com

Best Mutual Funds 2021 22 Top Performing Equity Sips

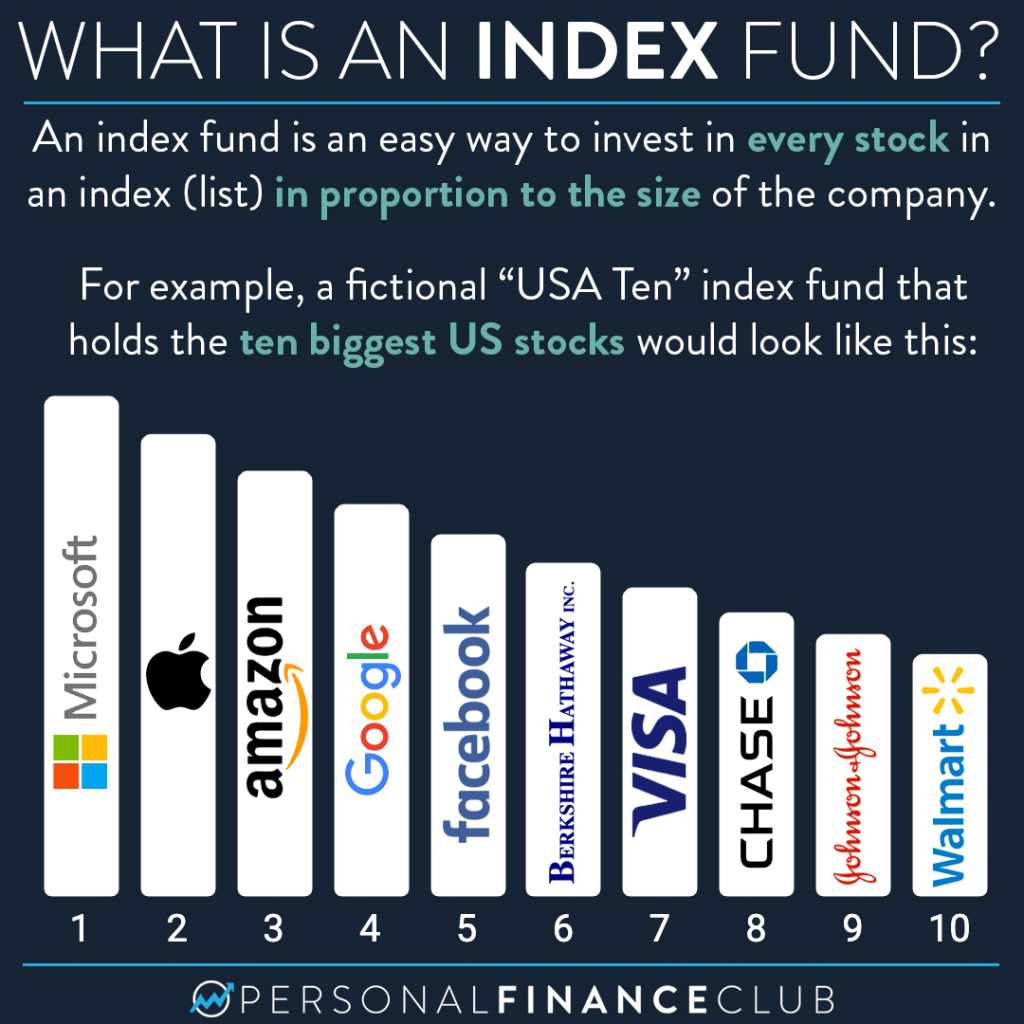

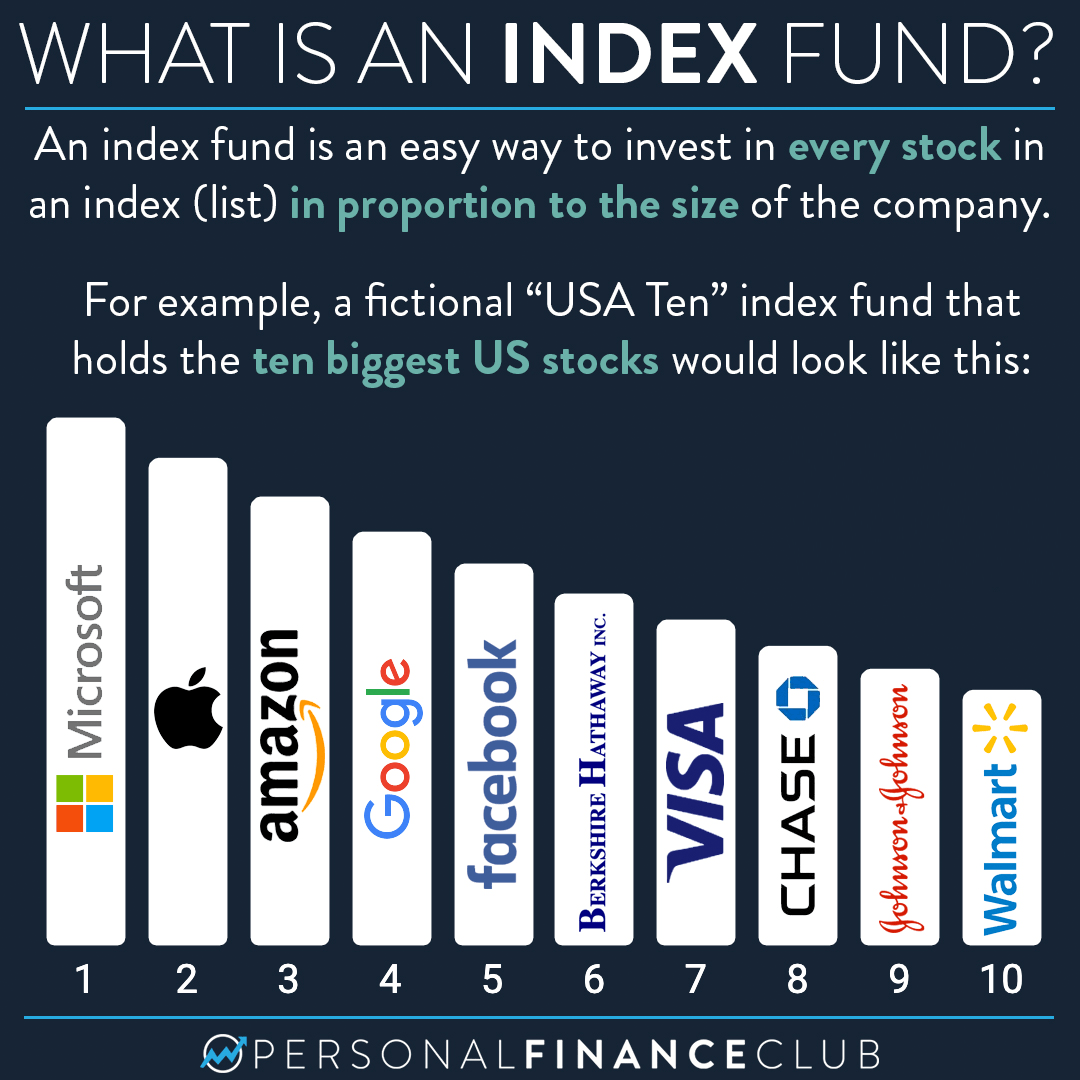

What Is An Index Fund Personal Finance Club

What Are Mutual Funds Vs Index Funds Vs Etfs Money

Etfs Vs Index Funds Which Are Better Currency Com

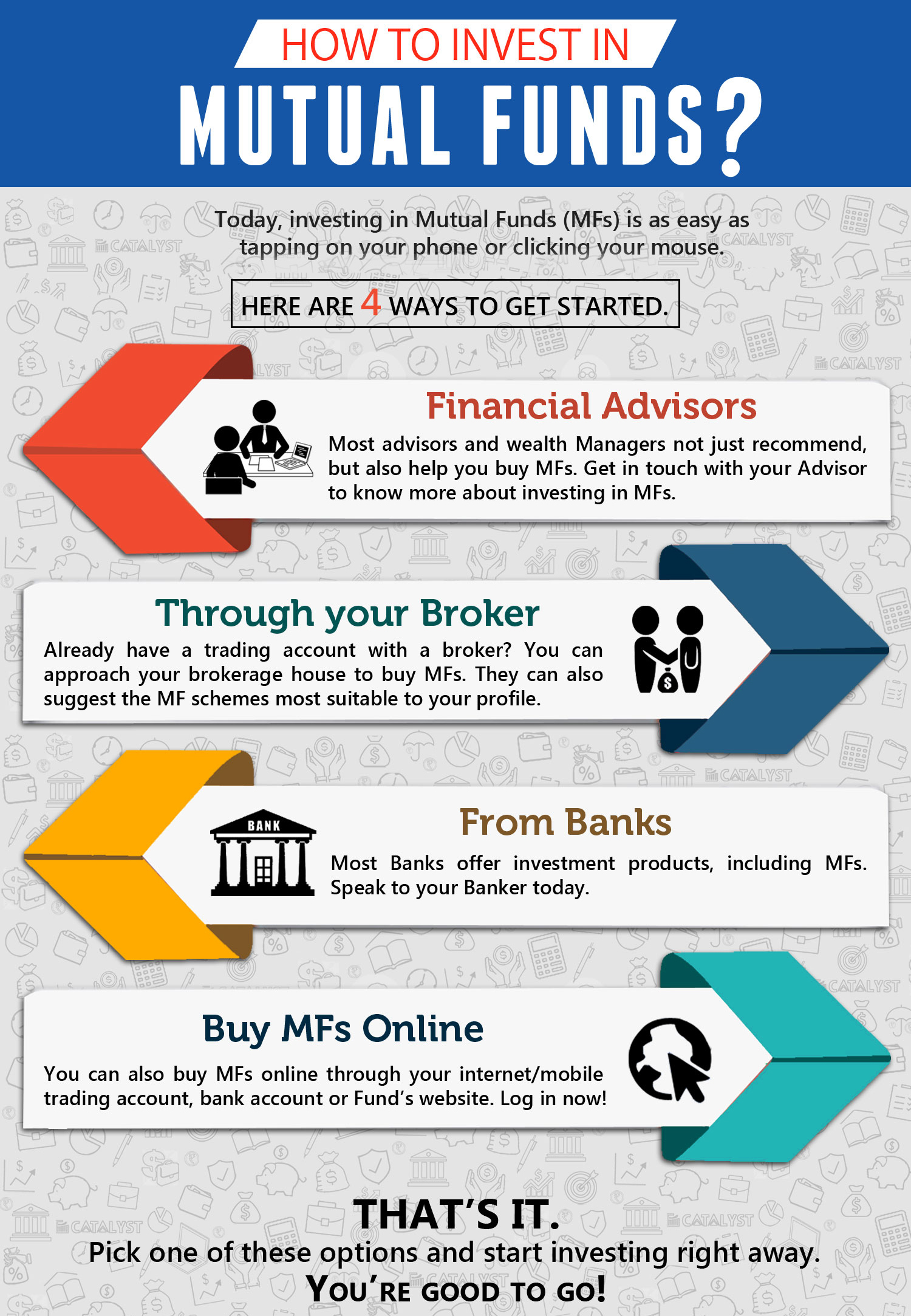

How To Invest In Mutual Funds Jamapunji

What Is An Index Fund Personal Finance Club

What Is An Index Fund Forbes Advisor

Index Fund Vs Mutual Fund What S The Difference Smartasset

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-02-051df666ccc24f06a8d2d8a09b8f4c24.jpg)

The Hidden Differences Between Index Funds

Index Fund Vs Mutual Fund What S The Difference Smartasset

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

Index Fund Vs Mutual Fund What S The Difference Smartasset

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-04-e87a6f8de5e14ab1a4a15f687bdb3ecf.jpg)

Comments

Post a Comment